In the last post - Stocks That Go Down: A Case Study - we looked at Carvnial Corporation, which I concluded is a good business with a bad business model.

Carnival’s business model specifically suffers from high degrees of financial leverage, operational leverage and cyclicality, which have become a toxic combination for equity holders.

In this post, we will look at a company with a bad business and a good business model, which has enabled the company to survive during periods of elevated uncertainty.

Medifast | An Unlikely STGU

Medifast describes its business as follows:

Medifast is the company behind one of the fastest-growing health and wellness communities called OPTAVIA®, which offers Lifelong Transformation, One Healthy Habit at a Time®. Reflecting the success of its approach to health and wellness for its clients, Medifast has consistently grown revenue ahead of peers and competitors. Of equal importance, our business model is expected to deliver long-term growth. Medifast has redefined direct selling by combining the best aspects of the model, while eliminating those dimensions that have typically challenged other companies. Medifast is often compared to diet and weight loss-only companies or to multi-level marketing companies, but our model is very different. The company supports clients through independent OPTAVIA Coaches, majority of whom were clients first.

Source: 10K Filing

The Business Model

Medifast’s business model is a “direct selling” business, which is a euphemism for multi-level-marketing in my opinion.

For those of you who are not aware of multi-level-marketing (MLM) models, they are a sales approach by which a company sells product via its client base rather than direct to its client base. The company creates financial incentives for clients to buy in bulk and re-sell through their peer network.

For the company this can make sense as they won’t have to hire salespeople, hold inventory very long or do as much marketing. Their clients turn into an outsourced workforce and warehouse. Smart!

There are several examples of successful MLMs that you may have heard of: Amway, Avon, Herbalife, Rodan and Fields, Beachbody aka P90X, etc.

In theory, the model seems almost ingenious and can work really well as long as the company and its clientele maintain good intentions. In practice, MLMs can often turn into usurious schemes whereby product is pushed into a vacuum of demand.

There are horror stories of downline customers financially victimized by their MLM upline handlers. It is all too common to hear of people who have lost a significant portion of their savings to what amounts to a get rich quick scheme.

To learn more about the alleged abuses of MLMs, I point you to some exhaustive work done by Bill Ackman on the space.

Bad Business

I suspect many of you are already familiar with the MLM model. You may even have had a friend or two get wrapped up in an MLM.

I also suspect that friend is either no longer your friend or you now have a garage filled with blueberry supplements from the curative Springs of Micronesia or some such thing.

MLMs are bad businesses not because they don’t make money but because they are often extractive to their customers. The value exchange is lopsided. The company gets to sell product at high margin with little inventory risk while the customer gets a bunch of product they often can’t resell and are financially burdened as a result. (Note: This is not to say all MLMs are extractive. I did just name a half dozen successful ones.)

You can’t exist for very long as a business when the value exchange is lopsided with your customer. When companies operate this way, they are operating with an expiration date.

The Numbers

Like always, let’s look at the numbers.

You will notice a few things in the chart above.

Medifast had a surge in revenue starting in 2017 that was coincident with the rollout of the Optavia brand, a line of supplements and other lifestyle products, which has been a financial success. Optavia represented just 17% of revenue in Q1 2017 and now represents nearly 80% as of the most recent quarter.

The Optavia boom appears to have tempered beginning in mid 2019, which has led to a deceleration in revenue growth as large as the ramp that preceded it. (This begs the question, has MED tapped out the Optavia opportunity?)

You will also notice that MED’s gross margins have been consistently in the mid 70s prior to the Optavia surge and after. High gross margins are never a bad thing especially when your costs are variable!

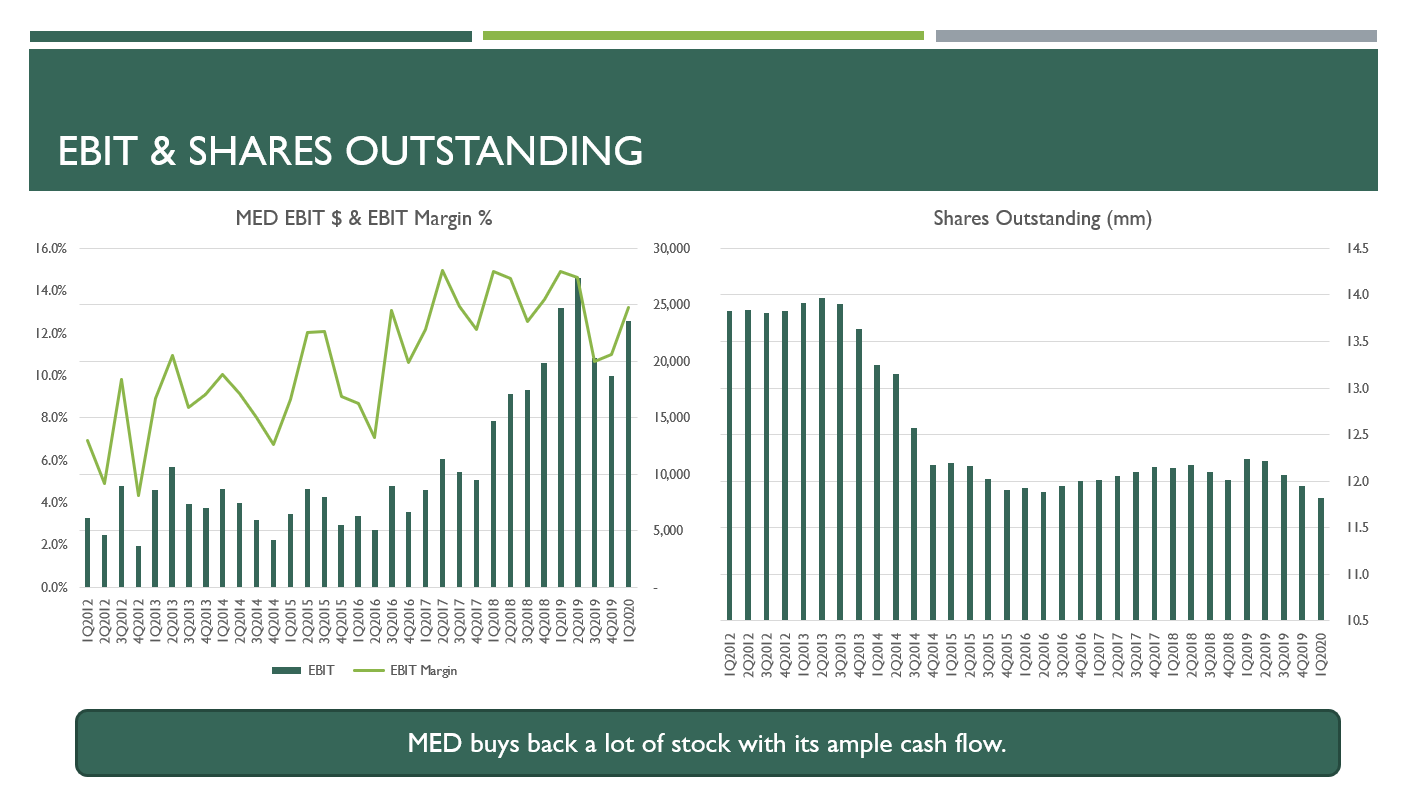

Medifast’s operating profit displays some degree of leverage in their business model. They saw a couple hundred basis point in operating margin expansion, which when coupled with the Optavia revenue boom turned into a sizable ramp in operating profit dollars.

Even before the Optavia boom, Medifast was keen to repurchase their own shares. The Optavia windfall has only strengthened their ability to do so.

Other financial items to note that are not shown:

Medifast has $91 million in cash on its balance sheet as of the latest quarter end

Medifast has no financial leverage

In short, Medifast’s business model displays high margin, low-to-no operating leverage and no financial leverage. In finance bro speak this is an “asset light, high-margin business.”

When STGU Go Down

In the last post I made a statement that stocks that exhibit high operating leverage, high financial leverage and cyclicality (denoted by STGD) draw down and never come back, leading to irrecoverable loss.

This is not to say that STGU can’t draw down. They do quite often, but are more likely to recover than STGD.

Remember in the last post when we talked about Carnival’s deceleration in revenue in 2012-2014? Their operating profit delevered by a third and probably caused some tension with lenders at the time. Their more recent troubles have caused existential threat to equity holders.

Medifast just had some pretty epic revenue deceleration as well with year-over-year revenue growth falling from 87% to 7%. Talk about wind coming out of their sails!

Look at what happened to the stock:

The Optavia boom and bust led shares from $50 to $250… and back again.

Medifast is down, but certainly not out - A stark comparison to Carnival.

Carnival’s rather mild deceleration in the most recent quarter led to margin compression of 650 basis points. Medifast’s gigantic deceleration saw almost no change in margin. This is the difference between a company with a high degree of operating leverage (high fixed costs) and a company with a low degree of operating leverage (variable costs).

Not only did Medifast’s margins barely budge in the slowdown, they have continued to make plenty of cash, which they have used to repurchase shares.

Sure their stock is down handily, but they continue business as usual.

Recoverable Loss

Even a substantial reduction in operating profit wouldn’t really matter in an existential sense. Medifast doesn’t have any debt, so their survival isn’t dependent upon on making $25 million per quarter or $2 million. They are going to survive either way and will have a chance to deal with any obstacles they encounter.

Now, if you are an equity holder and their operating profit goes from $25 to $2, it’s not going to be fun, but there will be a chance to recover. Unlike Carnival who had to mortgage their future to survive, Medifast can hunker down and survive the storm.

In short, Medifast has more options available to it than Carnival.

They have the option to scale back production to meet current demand; they have the option of scaling back SG&A in a pinch; they have the option to pivot into a new business. Hell, they even have the option of deciding not to operate for a while.

Carnival has no such luxury. Their business model precludes them from having the same options.

Is Medifast a STGU?

STGU can draw down for plenty of reasons: Margins, revenue deceleration, competitive threats, bogus short reports, etc. The list of potential issues is too long to list.

I contend that STGU benefit from business models that provide them implicit optionality when dealing with these issues. As a result, they can survive a wide array of problems and thrive on the other side as opposed to a Carnival that has its hands tied in a time of need.

Medifast is a great example of just that. It’s the reason I chose the company as a foil to Carnival.

The Answer

While Medifast has a lot of characteristics of a STGU, perhaps all of them, I am going to draw a line and say definitively, “Medifast is not a STGU… but is also not a STGD.” Medifast shall persist in Dubra purgatory.

Here’s why I say that: A key piece of the STGU Recipe is geometric growth opportunity. Related to that is customer value add. It is my opinion that “direct selling” (or whatever they want to be called) companies are more often than not extractive to their customer base, which erodes their geometric growth potential.

It is really hard to create a lasting and recurring brand-customer relationship if the customer is continually churned and burned. I argue Medifast will eventually suffer from exactly this. Thus, I declare it not a STGU. Close but no cigar!

I hope you all enjoyed today’s post. In the next post we will talk about implicit leverage and why it is so important to STGU.

-Dubra