Stocks That Go Up: A Recipe

The Recipe

I have found there is a recipe for STGU. It is these companies that have the privilege of trading at obscene multiples for long periods of time and compounding their revenue base year after year.

The recipe goes something like this:

1 | Geometric Growth Potential

What I mean by this is the company should be unconstrained in its growth. If a company serves large customers that can dictate the relationship (supplier to Walmart, for example) or is constrained by the number of people who just happen to walk in the door that day (a typical retailer), this is by definition not geometric potential, but linear.

Now there is nothing wrong with linear growth potential, but at some point you reach a limit - Your store or factory can produce no more or your major customer diversifies away into other suppliers.

The stocks that really do the best have geometric potential. They sell to everyone everywhere. These companies do especially well if scaling is not an overly burdensome process. If you can say with a straight face “this company will serve every person on Earth,” then that’s a good first step to becoming a STGU.

Example: Amazon | Counter Example: JC Penney

The power of geometric growth over linear growth is epitomized by Amazon versus brick and mortar retailers. Amazon sells everything to everyone everywhere whereas JC Penney sells whatever they have on hand to whoever decided to show up to the store that day wherever a JCP store happened to be… and only during business hours!

2 | Mutually Beneficial Customer Relationships

For a lot of the typical STGU, the customer derives value in some way by buying a company’s product and enjoys their relationship.

I cannot stress this second point enough. If your customers love the product or service (or are getting something useful out of it), they will buy a lot more of it. It is exceedingly hard to sell more to your customers when they hate you or are trying to cut back their spend.

Example: Carvana | Counter Example: Lithia Motors

I use Carvana as an example here simply because it’s the first company I could think of that in the year 2020 really outdoes their competition. This is a personal anecdote, but I’ve now bought 2 cars on Carvana and will certainly use the service again. The horrific experience of going to a dealer has driven me away from the competition. Lithia Motors’ loss is Carvana’s gain!

3 | Real Innovation - Expansion always in all ways.

Some companies talk about “innovation” in a false and manufactured way, others really innovate and bring more value to their customer relationship over time. The easiest way to grow revenue is often to introduce more products that your customers want. The best companies rarely stop improving existing products and adding new ones.

Example: Square (Cash App) | Counter Example: Wells Fargo

There is no better example of an innovative company than Square. Jack Dorsey has done an incredible job transforming this company from a simple payment processing platform for underserved merchants to an increasingly pseudo-bank of tomorrow.

The list of successful innovation at Square is staggering: Payments, Point of Sale, Lending, Marketing, Payroll, Business Analytics, Cash App, Bitcoin, Ecommerce.

While Square was doing all of this for its clients, what was Well Fargo up to?

4 | Ride The Wave

Don’t swim upstream if you don’t have to. Find a trend that is undeniable and ride the wave rather than try to fight it.

Example: Apple | Counter Example: Research In Motion

I recall the great debate of the late 2000s - Blackberry versus iPhone. It didn’t take very long before you could see (like see in the real world) Apple winning. Despite the obviousness of the iPhone’s success, many inherently dismissed Apple by betting Blackberry would maintain its dominant market position in what we now call smartphones.

The power of having the wind at your back for a company is a key ingredient. Riding the wave covers up for a lot of corporate sins - Bad management, poor M&A, soso sales operations, public faux pas, and so on. Even the most mediocre of companies can find themselves a STGU simply by riding the trend (hello 8x8).

The Takeaway

One thing a lot of STGU have in common is a mixture of unconstrained growth opportunity and product-market fit focused on enhancing the customer experience. Add an element of secular change as a tailwind and you’ve got an unbeatable combination of product adoption, value creation and innovation.

Examples of The Recipe In Action

Company: DocuSign

Growth Potential: Geometric. Everyone who deals with contracts is a potential customer.

Customer Relationship: High value add. Saves time, money, streamlines an increasingly archaic process.

Innovative: Expanding into contract lifecycle management and agreement analytics.

Secular Trend: Business processes move online and into the cloud.

Company: Zoom Video Communications

Growth Potential: Geometric. Everyone on the planet could be a customer.

Customer Relationship: Saves customer from a lot of hassle. Product just works the way it should.

Innovative: Expanding into office productivity tools and probably also UCaaS at some point.

Secular Trend: Distributed workforces & corporate communications

Company: Square

Growth Potential: Geometric. Everyone on the planet could be a customer.

Customer Relationship: Saves customer time and money. Enables frictionless banking services to the underbanked and very young. Likely very strong customer loyalty (Cash App).

Innovative: Has innovated so many times I’ve lost count.

Secular Trend: Traditional financial rails disrupted.

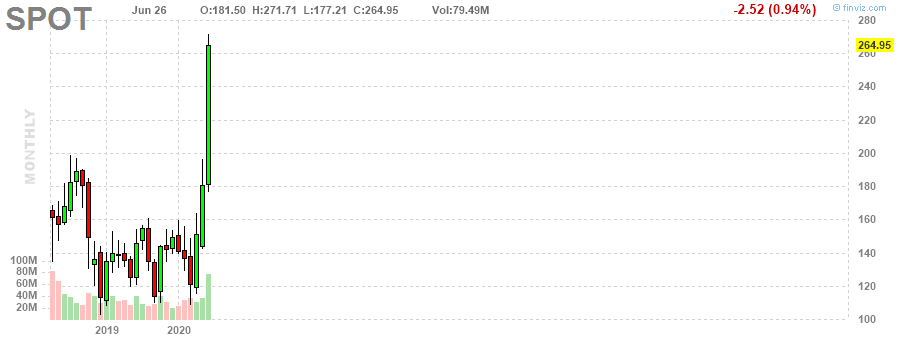

Company: Spotify

Growth Potential: Geometric. Everyone on the planet could be a customer.

Customer Relationship: Seamless access to music and audio content. Likely strong brand loyalty.

Innovative: Podcast content.

Secular Trend: Disintermediation of traditional media and broadcasting.

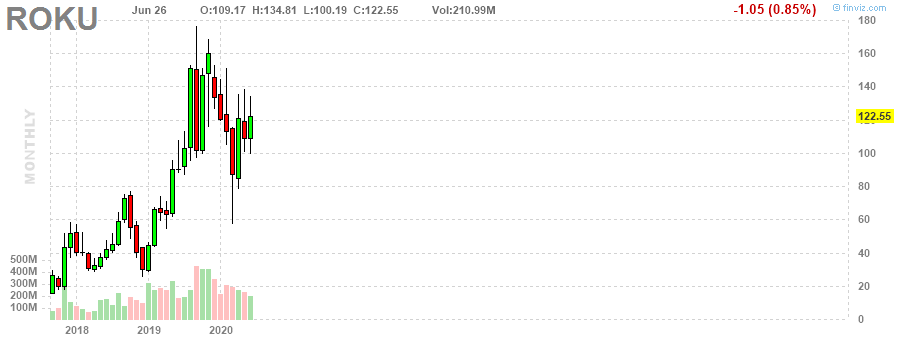

Company: Roku

Growth Potential: Geometric. Everyone on the planet could be a customer.

Customer Relationship: Provides access to streaming video content to viewers. Provides high value advertising inventory for advertisers. Likely strong brand loyalty.

Innovative: Industry leading advertising inventory and analytics.

Secular Trend: Streaming TV & Legacy media disintermediation.