Semrush (SEMR)

Almost certainly a Stock That Goes Up (STGU)

Hey there, everyone.

It’s been some months since I posted anything. I didn’t really have much to say about the market or Stocks That Go Up (STGU), so didn’t post.

Note: Don’t know what makes a STGU? Click here

In fact, since February it has been a pretty bad market for STGU. Coming into the year, valuations were too high, speculation was too pervasive, the threat of higher interest rates loomed and so on. It just wasn’t a good setup for STGU.

From February until about mid May we witnessed a quite sizable growth-to-value factor rotation that saw STGU become STGD (yikes! I know). Well, that rotation created opportunity for the STGU crowd.

There’s one opportunity in particular that I would like to highlight today: Semrush.

Semrush (SEMR) went public in late March in the depths of the growth-to-value rotation. To illustrate the lack of appetite for growthy software businesses at that period of time, SEMR went public at $14, a price at which some insiders actually purchased shares in the company, and quickly traded to $11. The same fate befell DigitalOcean (DOCN), which is another of the March 2021 IPO vintage, so it wasn’t just SEMR that found itself out of favor.

That lack of appetite is now our opportunity.

Note: It is also worth noting that insiders, including private equity did not sell a share in the IPO, which demonstrates belief in the business model and forward outlook.

What is Semrush & What do they do?

Semrush is a SAAS business that offers SMBs, internal marketing departments and marketing agencies a platform for managing a business’s digital presence, namely through SEO.

SEMR started in 2008 as a single point solution for search engine marketing and has since expanded its offering to become a broad online visibility management platform offering the following services:

Search Engine Optimization (SEO) Improve organic (unpaid) website traffic / brand awareness

Pay Per Click (PPC) Improve inorganic (paid) website traffic / brand awareness

Social Media Marketing (SMM) Improve customer engagement on social media

Content Marketing (Content) Create content across all digital channels

Digital Public Relations (PR) Grow digital media presence

Competitive Intelligence (CI) Gain insight on competitors’ traffic / ad strategies

Today, SEMR offers 51 different products to its end users as outlined by the graphic below:

To put it simply, SEMR helps an SMB do the simple blocking and tackling of handling search engine marketing. Said another way, as visualized by the company graphic below, SEMR sits atop the marketing funnel.

Their job is to help an SMB or brand be in the right place to become noticed on the internet and subsequently catch the attention of likely customers.

The beauty of SEMR is that it can be as simple as informing an SMB where their digital traffic is coming from or as complex as helping them run a full-spectrum content marketing or public relations campaign across platforms including the major social media platforms.

It is the bundling of disparate point solutions into one platform at a reasonable price that has made SEMR the 800 pound gorilla in online presence for SMBs. Client testimonials confirm this:

“Thousands of dollars of benefit”

“All-in-one tool at a discount; would pay much more to replace SEMrush with several tools”

As an aside, this reminds me a lot of The Trade Desk (TTD) when it went public in 2017. The key innovation that TTD had made as a demand side advertising platform was committing early on to offering multiple different advertising products while competition largely remained monoline (i.e. Display ads only or YouTube ads only, etc).

SEMR is similar in that it does a little bit of everything. From what I gather, SEMR’s bread and butter was always keyword related - tools, analysis, optimization, etc. and still is to this day. But they didn’t just stop there. SEMR kept adding services that its core clients wanted. And this is the key - They went from being a point solution to a full fledged platform.

It is this multitude of products that gives it an edge over competition. Take competitor Ahrefs, for instance. Ahrefs is known for being the best backlinking tool. So if you are just going to do backlinking, you choose Ahrefs. But if you need anything more than that, or frankly don’t even know what you need and you begin to add more point solutions, quickly it becomes cheaper to choose SEMR. That is their value add - Everything you could possibly need at a good price.

Therefore, SEMR represents the affordable all-in-one platform with best-in-class tools for all things SEO.

Show me the numbers

I am keen to visualize the financial performance of companies. As part of that, I like to put together slides like the ones below.

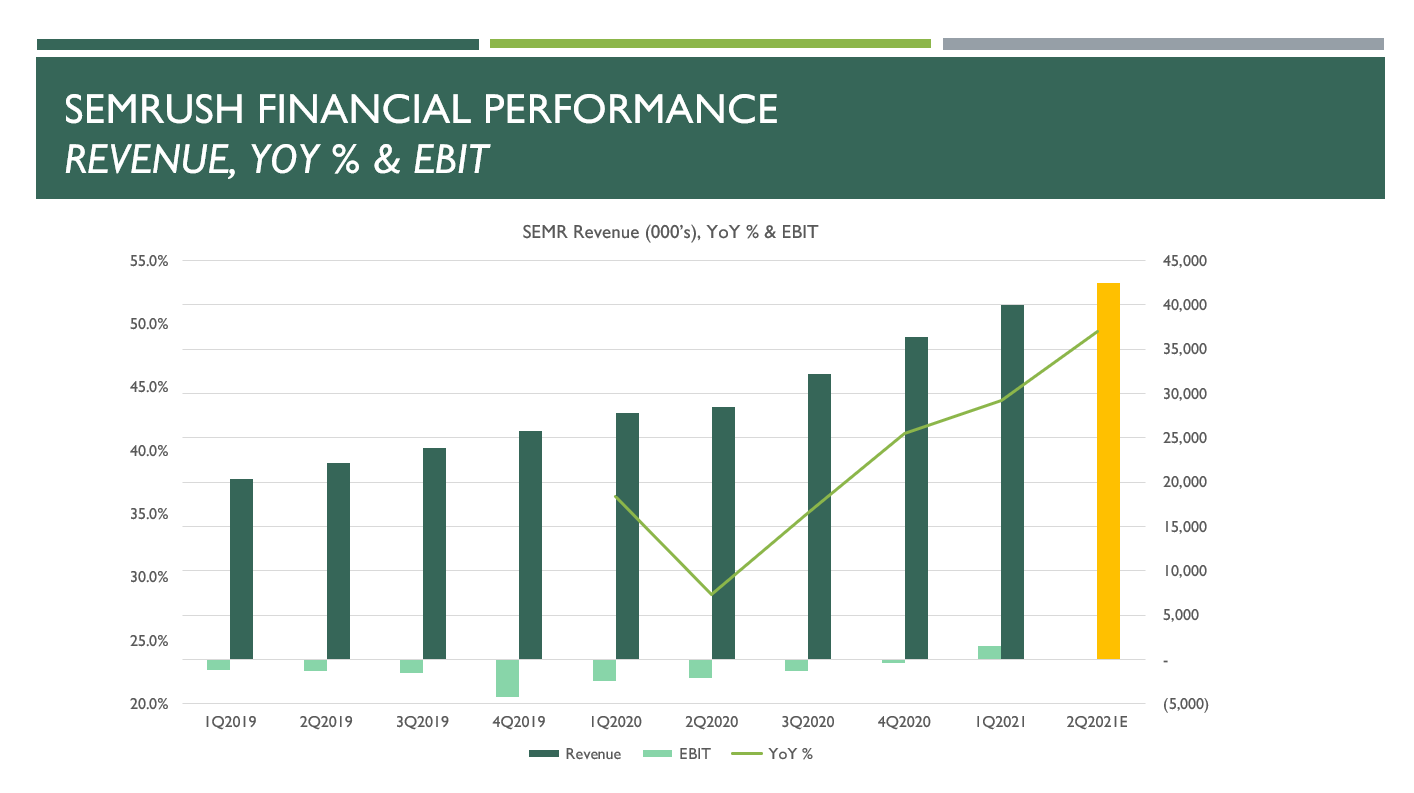

As you can see, SEMR currently has about $40m of quarterly revenue as of Q1 2021 growing in the mid 40’s% YoY and slated to accelerate handsomely through the Q2 Covid-19 lap. Also, gross margins (not shown) have hovered in the mid 70%, but as of last quarter came in at 78% with incremental GM’s in the low 80s. So strong topline is driving efficiency downstream in the business model.

Moreover, operating income is now positive, which is quite rare for the high growth group. Typically you see substantial operating losses as companies are pushing to maximize customer acquisition and topline growth. The beauty of SEMR’s model is their substantial pool of freemium customers that convert at predictable intervals and represent a very low CAC pool of paid converts.

Because of this CAC efficiency, SEMR has hit escape velocity on an operating basis, which puts them in some pretty rarified air. There aren’t too many public companies out there growing topline >40% while also generating cash. Pretty sure you could count those names on one hand.

Aside: I love financial models that look like SEMR’s. This is a company that exhibits strong sequential quarterly growth, very high gross margins, insanely high incremental margins, and has a history of operating within cash flow as evidenced by their positive operating income. Frankly, this is the type of financial model that Benjamin Graham could only have dreamed of. It would have knocked his socks off.

The efficiency and effectiveness of this financial model is demonstrated by the fact that from 2008 through the IPO, SEMR only raised $37m of venture backing, which in the 2010’s is effectively the same as not raising any venture money. As you can see in the exhibit above, SEMR showcases the highest return in terms of run rate revenue per venture dollar invested of all of the online visibility management companies. And it’s not even close. They took very little venture money and turned it into a business that rivals HUBS circa its IPO. It’s impressive.

And by only raising a small amount of money, not only did the founders show reluctance to cede equity in the business (a good thing on its own), but they didn’t really need the money, which is the even better part and is confirmation of the quality of the business model.

If SEMR’s revenue growth is notably strong, how are they doing on KPIs? They are equally as stout if not more so. SEMR has 72,000 paying customers as of Q1 2021. They are net adding about 5,000 paying customers per quarter, most of which is converting from its pool of 400,000+ active free customers (note those are 400k customers not using competing products, a testament to the Freemium model). This represents user growth of ~25-30%, which could accelerate as new products hit the market and find popularity.

Annual recurring revenue (ARR) is growing quite a bit faster at >50% as of the last quarter and likely to grow >40% on the full year. The implied ARPU increase is explained by customer seat expansion, upgraded tiers and the addition of add-ons, many of which are ala carte as customers expand their usage beyond simple SEO/SEM. This is proof that not only is SEMR good at converting to freemium to paid, but they are quite skilled at penetrating their paying customer base and lifting ARPU, which is a key growth driver going forward.

Note: You’ll notice that ARR per customer popped significantly in Q1 and is slated to decelerate in Q2 at midpoint of guide. Something tells me Q2 is going to come in much stronger than guidance implies driven by both the Covid lap in Q2 and the continued strength in net adds.

What is there to get excited about?

Before we get into the interesting things to get amped about, let’s take a quick look at the multiple discount SEMR has to the high-growth software group. If you strain your eyes, you can spot SEMR in there somewhere.

Besides the blistering growth at EBIT breakeven and substantial valuation discount to the high-growth software group of public companies, there are a couple of other things to get amped about.

First, SEMR just raised prices for the first time since 2017. Effective January 4, 2021, SEMrush raised Pro, Guru, and Business pricing by 20%, 15%, and 12.5%, respectively. Existing customers are grandfathered in under their old pricing regime. That is, until they upgrade. This will be a tailwind to ARPU throughout the year and is further support that ARPU will not decelerate in Q2.

Second, SEMR’s product roadmap will open up some new and significant markets that should expand TAM and mitigate some of the historical reliance on SEO/SEM. SEMR is launching or has launched the following products in recent weeks in an attempt to further broaden their product offering and expand into new markets:

SEMR has launched an App Directory which is the company’s first foray into marketing mobile apps.

SEMR has launched SEMR Marketplace, which is best described as a ghost-writing service to help clients craft their online presence through curated content and the like. Think UPWK/FVRR for SMB marketing.

SEMR launched an Amazon/ecommerce product called Sellzone that helps Amazon sellers improve SEO / organic search results on Amazon.

Finally, SEMR has made a push (in a very TTD-reminiscent way) into expanding their relationship with agencies and connecting those agencies to their clientele.

Note: All of these new products are add-ons and should be incremental to ARPU.

Third, while Apple’s recent iOS privacy changes may have shaken up the ad industry, they have actually become a boon for traditional SEO/SEM spend. According to people in the industry, SEO is now top of mind for those whose in-app or email marketing campaigns have been impacted by iOS changes. This should see SEMR’s core business see at least a temporary inflection.

It is also important to note that SEMR does not track and does not sell ads, so their product is not at risk from the iOS privacy changes. They are impacted - positively so - by changes in Google’s AdWords. When those changes happen, customers rely on SEMR’s tools to see the extent of the impact on their online presence.

Competition

Competition is probably the biggest question mark for most investors who have looked at or will look at SEMR. There’s a lot of them and they range from small companies you’ve never heard of to the big boys (GOOGL, FB, MSFT).

SEMR’s closest competition are Moz and Ahrefs, who compete directly in the original SEO/SEM business. However, the competitive threat represented by Moz and Ahrefs seems to dissipate by the day.

Moz, which failed to make the move from SEO to SEM, announced only recently it was to be acquired by J2 Global, which is a public company well known for acquiring online businesses only to prioritize current cash flow over growth expenditure. At this point we should consider Moz to have effectively exited the market.

As for other competitors like Ahrefs, their competitive positioning may struggle now that SEMR have completed a successful IPO and have ample access to capital in the public markets and can therefore be a bit more aggressive in taking share.

The more concerning competitive threats lie in the newer business lines - SMM, PR and CI. There are ample competitors in each that are well entrenched and offer great products. However, I would argue that many of these logos are tangential competition at best rather than direct threats. Also there exists the ability of SEMR to grow into a legitimate threat to these incumbents as their SMB customer base matures.

Take Hootsuite and Sprout Social as examples. Those are dedicated social media platforms. Sure they offer the entire funnel from customer awareness to customer feedback, but only on social. One might argue that a marriage between a Sprout Social and Semrush would actually be a formidable fully integrated online visibility management company.

The same idea holds for a marriage between Hubspot’s dominance in client management and content optimization and Semrush’s dominance in SEO, SEM and PPC. That is to say, I think the two are more complementary than they are competitive. In fact, I wouldn’t be surprised at all if HUBS attempted to acquire SEMR. Their headquarters are a mere 2.5 miles apart.

Note/Aside: I like to think SEMR is vastly undervalued when looking at the market value of Sprout Social (SPT), which as of today is $4.5 billion. You see, SPT has 28,000 paying customers as of MRQ (albeit at a much higher ARPU and different use case) versus SEMR that already has 20,000 users of its social media product. I like to think there is a mini SPT embedded in SEMR.

What’s the pitch?

In a nutshell, the pitch is this:

"SEMR is a best of breed SEO/SEM service provider to SMBs that has made the transition from point solution to a platform company. SEMR has successfully gone upstream with value added services and add-ons that expand ARPU, increase TAM and strengthen stickiness of the platform.

SEMR outcompetes competition through their reasonably priced, high-ROI core business. Moreover, product innovation has strengthened and deepened SEMR’s competitive differentiation and bolstered the pricing power of the platform, which ensures strong growth for the foreseeable future."

SEMR is long passed the product-market fit debate. We are well into the adoption phase of this company’s life cycle. As such, we have the great pleasure of sitting back and watching SEMR’s management team execute on their platform expansion strategy.

The next 3-5 years are likely to see SEMR continue to grow revenue and EBIT sequentially as they layer on new customers, new products and further penetrate existing and new markets. This is a true “growth always, in all ways” kind of name given the sizable nature of the end market.

I think an investor can safely underwrite an investing expectation similar to HUBS circa 2015 when they were growing >50% as SEMR is likely to do this year. I contend SEMR should actually trade at a substantial multiple premium to HUBS given the early EBIT profitability and larger customer base, but I don’t want to get ahead of myself.

Why now?

SEMR trades at a substantial discount to the high-growth saas group (12x EV/NTM Rev vs group at ~24x EV/NTM) and I don’t think this discount will last long at this extreme. In my mind, it is attributable to two things that are easily corrected: Low float and management’s ability to communicate with the Street (i.e. Wall Street awareness).

First, SEMR is an extremely thinly traded new issue. There are only 10m Class A shares outstanding, many of which have been acquired by institutions and aren’t moving (see filed 13Gs, in particular Ancient Art). This low float precludes the ETF complex from establishing a bid under the shares due to daily liquidity constraints. We see this with a lot of new issues. Paradoxically, it takes an offering of shares (and thus higher daily trading liquidity) to bring in the big pools of capital who will endlessly bid on shares lucky enough to have an allocation in such a fund structure. Once this liquidity comes to market and SEMR shirks the “thinly traded” label, I expect the shares to react accordingly.

Second, two gentlemen founded, manage and own most of Semrush, Oleg Shchegolev and Dmitry Melnikov. They are Russian nationals and English is not their first language. I don’t say this to demean them, but they have heavy accents and are hard to understand. It is this communication element that I think could improve awareness on Wall Street. It’s my opinion that the company could benefit from bringing in someone from a Hubspot or Google to be the face of the company for Wall Street. It sounds like a stupid idea, but sadly it would work.

What am I playing for?

I can say with a straight face that I think SEMR can be a $100 stock within 3-5 years.

If you underwrite strong growth for the next 5 years, call it paying customer growth of 25-30% and ARPU of 10-15% (which could be conservative given product velocity), you’ll be looking at a business with 300k paying subs and nearly $1 billion in run rate revenue (and at that point probably a ~30% free cash flow margin). That doesn’t seem crazy given that today they already have 400k active free customers. That level of customer penetration within 5 years actually seems reasonable especially at their price point.

What would that company be worth in 5 years? If you assume no multiple expansion and just brute force compounding, $12 billion, or $80 per share. Even modest multiple expansion toward the direction of inline with peers can take you well over $100.

You either benefit from a swift multiple re-rate due to market awareness or the inexorable march of market share capture and expansion. I tend to think it will pay to be patient with this one.

Disclaimer: I hold shares in SEMR. This is not financial advice. Do not trust an anonymous person on the internet for financial matters. Do your own due diligence. Consult a financial advisor. Be responsible.