Expensify (EXFY)

Expense Reports That Don't Suck

Hey friends! It has been a while since I posted (yet again). 2021 just has not been a great year for Stocks That Go Up (STGU). In retrospect, 2020 was too good and things needed to cool off.

Note: Don’t know what makes a STGU? Click here

The factor rotation action that began in February 2021 has continued for most of the year. Recent weeks have seen an increased intensity of this rotationary action via an interest-rate-threat-induced selloff in many of the great STGU. Rightly or wrongly, STGU are labeled as “duration assets” by the CFA crowd and so when rates rise, STGU start to act like STGD. It’s just how it is.

In times like this, it’s hard to have conviction about something enough to put pen to paper. Hence, why I have not written much this year (except for SEMR, which I still think is going to be a monster as a public equity).

Today, I am breaking my dry spell. Recently I came across a company that I think has similar potential to be a monster stock. I’ll be the first to admit that the setup in terms of timing probably isn’t the best (we will get into that), but pattern recognition is telling me that this one is worth the time to review and be ready for.

That company is called Expensify, ticker symbol EXFY.

What does EXFY do?

The company says what they do pretty well.

“Expense Reports That Don’t Suck” as a slogan says a lot about this company. They’re funny. They’re self-aware. They’re not trying to fool anyone with some slogan like “Workplace Efficiency Solutions.” EXFY exists to make doing expense reports less painful. And in that pursuit they do a great job.

This slogan also speaks to whom the company is trying to sell. When a company is pitching the Bossman, they’ll use a phrase like “Workplace Efficiency Solutions.” Bossman will nod knowingly and think to himself, “They just mean they’ll make expense reports suck less.” When a company is pitching the Everyman, they drop the charade.

This is exactly how EXFY sells - bottom up and through word of mouth. All it takes is a couple sales guys to start using the free app and the clock starts before the Chief Accounting Officer or Controller caves and signs up for the paid service. EXFY has a nice graphic in their investor presentation demonstrating this go-to-market strategy.

How is EXFY Innovating?

But Expensify doesn’t just want to be the expense reports company. They have other products live today and a hefty roadmap for the future. Live today are expense reports, bill pay, travel bookings and a free corporate charge card. Services to come include payroll processing, customer chat functions and Wallet, something akin to Venmo.

I think it is worth reading the prepared remarks from CEO & Founder David Barrett from the Q3 2021 conference call. He outlines precisely what the company does and where he sees them going. (Emphasis Dubra)

David Barrett Q3 2021

Great. All right. So as you know, or you might know, we have a big vision, and that vision involves a lot of development over a long period of time. So now Expensify is not just an expense reporting app. It's very much a payment super app.

OK, eyebrows raised. I want to hear more about super apps.

… We've built a universal payment engine that can adapt for a wide variety of digital use cases.

And so if you look kind of across the top here (Barrett is referring to the slide directly above), and I highlight a few different colors. So first, the items in blue. These are functionality that in the Expensify app is already live and you can use. And so we're obviously still going to improve all of these, but these are real features that are in market today. So you can use our Concierge Travel feature to book travel through chat.

Of course, you can send an invoice to anyone else using Expensify and collect online. Likewise, whoever you send an invoice to, they receive our bill payment experience where they can basically process bills and export in the ledger system and pay them online. Of course, we have a world-leading smart card, the Expensify Card with 1 million different batches. And of course, we also have our expense management platform, which scales everything from sole proprietors up to large enterprise. And so these are all features that we've built on this common platform.

Note here that Barrett refers to his core expense management offering as just a feature on top of a payment system, which in his mind is the actual product. That is interesting by itself. It is exactly how Jack Dorsey talked about early Square.

Also when Barrett refers to large enterprises using Expensify he is not kidding. Some of the largest tech companies in San Francisco with thousands of employees use it in their operations.

They use the same experience across all of them. What we're working on right now, I would say, are the kind of the green bullets here. And these are all items that already exist in beta or in internal use. So going from right to left here. So we actually built our own payroll solution using the exact same technology we currently have.

In our world, paycheck is just an expense report submitted twice a month automatically for you and then with some tax chunk on top of it. We use our own payroll internally. We haven't launched it yet externally. And so we're still working on it, but I just want you to know.

Eyebrows raised more. Payroll is a significant incremental addressable market increase if it is going to happen. Not to mention that PAYC and PCTY (two other disruptive payroll players that are publicly traded) have over $35 billion in combined market cap. Barrett is clearly going to shoot the moon at EXFY. He’s thinking really big.

Barrett goes on to talk through his consumer wallet functionality and his ideas around how chat is best layered on top of the expense/bill pay/invoicing services. I’m skipping over this because it is not yet a concrete product and veers into “galaxy brain” territory. He does begin to talk about building transaction revenue:

…And that's the key to our growth, is basically 0 marginal cost growth throughout all these different industries. Of course, it creates all sorts of transactional income as well.

When I first heard this, I thought, “No way!” Turns out, EXFY runs on a payments (at least in this case) database called Bedrockdb that is a fork of SQLite developed by Mr. Barrett himself that is designed for speed and scalability. Additionally, they run Bedrock on leased, custom-built high density core count servers provisioned for many multiples of their current load. So when Barrett says he can add functionality at zero marginal cost, all he is thinking about is putting more load on the servers and hardware he already leases.

And so basically, everything from travel, invoicing, bill processing, all of this basically creates high-value transactions revenue. And then likewise, of course, is the subscription revenue that comes from the top end of functionality.

…

What we just launched in Q3 is this new Free Plan, which allows new companies to adopt Expensify without having to adopt expense management. This means that you can actually adopt the Expensify Card as a card-first design. This is a brand-new thing. We just launched it, and we're going to break out results maybe in the future, but not yet because it's still too early here.

Likewise, we launched a new cash back built into the Expensify Card. This is to drive faster adoption of the Expensify Card because when you adopt a corporate card program, it's not like all your employees immediately switch over on day 1. So this is just one of the many tools that we use in order to drive faster adoption, and this is a new thing that we just launched in Q3.

Phew, that’s a lot to take in. Sorry to make you read all of that!

But it is worth it to see how Barrett is thinking of the business. EXFY is now full steam ahead in some major new growth vectors that will take this business into new addressable markets. EXFY has already started with the Expensify Card as a means to drive adoption of the core expense business and begin generating transaction income.

Not only are they offering incentives (lower subscription prices) to current expense platform customers to adopt the card and begin using it, they are now giving the card away for free to prospective customers as a carrot. There is a saying in marketing that applies here, “Nothing beats free.” It’s genius. It’s the Red Bull approach to expanding your customer base.

Next up will be payroll as EXFY look to better service their already big customer base.

Growth always, in all ways!

Funding History

I’ll be honest, when I was reading the S-1 and hearing things about “super apps” and EXFY’s eyes-bigger-than-its-stomach growth plans, I assumed this business burned approximately a gazillion dollars. After a year and a half of completely bogus SPAC IPOs making similar claims, it’s just a reflex so you’ll have to excuse me!

EXFY is another one like SEMR that didn’t raise that much venture money and has been internally funding its growth for a while now. EXFY only raised $38.2 million, which in San Francisco gets you an office space with no bathroom and water dripping from the ceiling.

That’s a joke, but on a serious note, it’s quite an accomplishment of the team at EXFY to have scaled so quickly into a position where they can control their profitability.

EXFY must have been surprisingly profitable early or not have needed the proceeds from later rounds of funding because in March 2018, they apparently fully redeemed their lead Series A investor, Redpoint.

Stock redemption agreement

In March 2018, we entered into a Stock Redemption Agreement with Redpoint Associates IV, LLC and Redpoint Ventures IV, L.P. (together, “Redpoint”) pursuant to which we repurchased 1,616,947 shares of our Series B Preferred Stock, 46,952 shares of our Series B-1 Preferred Stock and 118,251 shares of our Series C Preferred Stock from Redpoint for an aggregate purchase price of $43,605,464. As a result of the repurchase, Redpoint no longer beneficially owned more than 5% of our capital stock or had the right to designate a member of our board of directors.

You never see this, meaning you never see a startup redeem an early investor in full outside of the context of a refinancing. You just don’t.

Most of the time startups are begging for more cash. In the cases where they aren’t, VCs have no reason to sell.

The only question I have is what happened? My guess is Redpoint and Barrett had some disagreements and this is how it culminated.

Update: Barrett discusses what happened with Redpoint in an interview, which can be found on Spotify.

In any case, Redpoint cashed in their $5.7m 2010 Series A investment for $43.6m, or $24.50 per share, in 2018. There is no doubt in my mind that this was done by EXFY in a position of strength.

Let’s Visualize The KPIs & Financials

As regular readers will know, I enjoy visualizing companies’ key performance indicators and major financial metrics. It just feels better than to stare at spreadsheets.

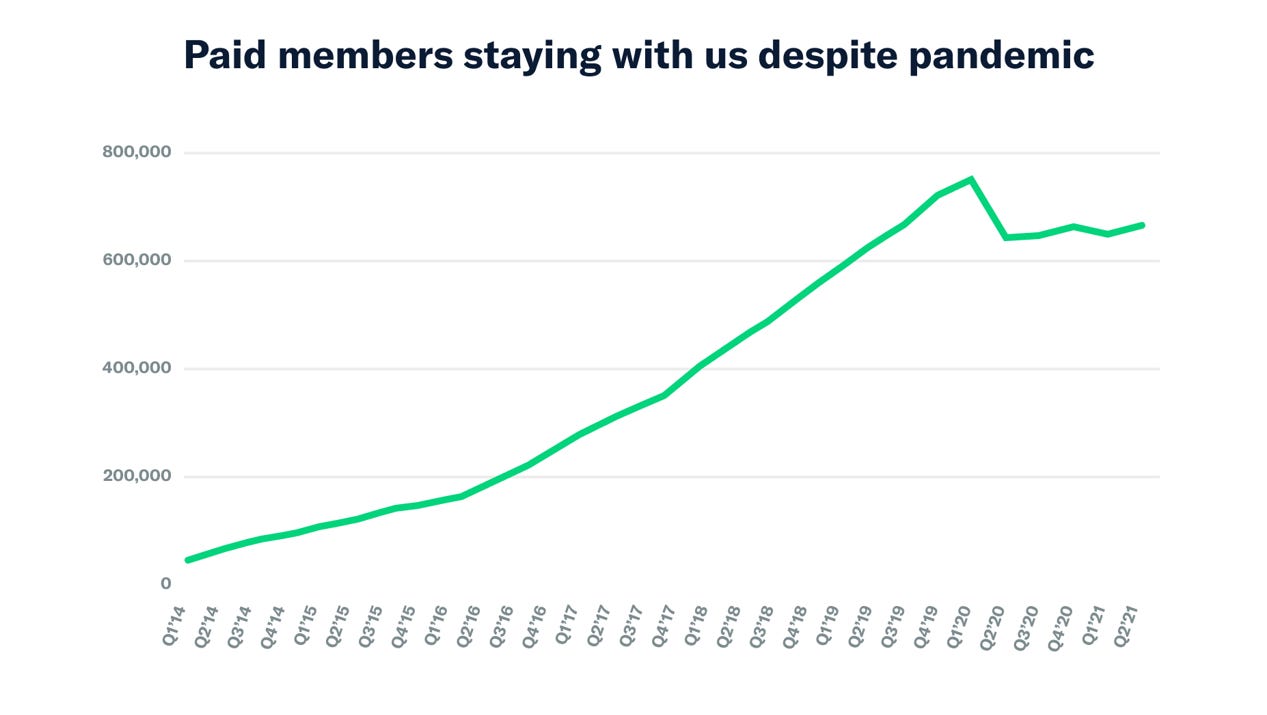

The most relevant metric for EXFY is paid members, meaning the number of people for whom their employer is paying subscription fees. The vast majority of these members use EXFY’s core expense products for their professional travel and expense items.

You’ll notice paid members fell off a cliff in Q2 2020. That was the pandemic hitting their business. Given that this business in its current form is tightly correlated with travel and entertainment (T&E) expenses and T&E expenses ground to a halt at that point in time, that drop in users makes sense.

Also notice that logo retention was largely unchanged from 2019 to 2020 while net seat retention swiftly declined. This tells us that a significant amount of EXFY’s revenue is tied to activity, not necessarily logos. That is to say, from a customer’s perspective, EXFY can be a variable cost to a certain extent, just something to keep in mind given the backdrop of a T&E recovery.

Here is a longer term look at Paid Members

What was a predictable path of growth suddenly became very uncertain. I’ll ask a question:

Faced with a global pandemic, countries adopting lockdown policies and almost a complete freeze of corporate travel, what would you have done as CEO of Expensify? Would you have raised prices and made an annual plan non-cancelable? No way.

Guess what David Barrett did. Yup, he did. The mad man did that. From the S-1:

While activity decreased and remains at lower levels than pre-pandemic, our revenue only declined until the quarter ended June 30, 2020. This initial adverse impact on revenue was mitigated by the prevalence of our annual contracts and minimum user requirements in those contracts as well as a price change that became effective in May 2020. We introduced the Expensify Card in 2020, immediately before the pandemic.

…

In May 2020, we updated our terms of service whereby annual contracts became non-cancelable.

In retrospect it’s genius. He rolled out the price increase at the same time he rolled out the Expensify Card and grandfathered in legacy pricing as long as companies used the card for certain levels of spend. This price increase explains why average revenue per paid member has escalated so quickly year-over-year in 2021. In addition, it likely caused low usage users (i.e. low ARPU) to churn.

Note: This increase in ARPU will not repeat again next year.

This killed two birds with one stone. On the one hand, it “sold” the Expensify Card and on the other it revealed how many loyal customers there really were, which was approximately 630,000 paid members.

Given the backdrop of global pandemic, T&E spend grinding to a halt and massive sequential decline in paid members, you would have expected EXFY to hemorrhage cash at least for a quarter or two while they rightsized their expense structure.

Nope, they were EBIT profitable in Q1 and Q2 2020. This is a mighty achievement and a testament to a very lean, anti-fragile business model as 1H 2020 could be considered a “worst case scenario” for a business like EXFY. Take a look at their financials below. It’s remarkable.

What is the setup?

I said in the beginning of this post that the timing on this one is not perfect. In fact, your average hedge fund guy would put this one on the back burner for one simple reason: The 2021 lap.

EXFY had a really awful 2020 from a growth perspective. It was probably the first time in a decade revenue declined sequentially and in YoY terms. They had a complete stall out of activity.

Then Barrett did the price increase and things started to improve from a customer retention perspective coming into 2021. This caused EXFY to optically grow at a much faster rate than it actually is growing. As of the most recent quarter, EXFY grew topline at 73%, but up against a very easy lap of 6% in the year ago quarter. The laps will only get harder from here and will make it look optically like topline growth is slowing way down.

Hedge fund guys who wear loafers hate that kind of thing. I, on the other hand, am willing to lean into the uncertainty provided by the lap.

In the near term

If you buy the stock today you are betting on a couple of things in the near term. First, that the EXFY card can drive meaningful paid member attachment and/or reduce churn significantly. In addition, you are betting on a normalization of T&E activity at client companies, which alone could cause usage-based customer spend to increase quite a bit.

Do not sleep on this normalization effect. Some customers on usage-based contracts have seen their monthly bills decline 90%. A return to even half the historical usage is a big lift for EXFY.

Additionally, reducing churn by itself could be a significant boon to EXFY as they are currently adding ~20k net new paid members per quarter as of Q3 2021. Back in 2019 when they had a similar number of paid members, they were adding ~40k net new per quarter. I don’t think anyone on Wall St is expecting that kind of snap-back in growth for 2022, so if it happens, it will surprise a lot of people.

In the long term

In the medium to long term (i.e. 3-5 years), you are betting that the various growth vectors discussed by Barrett layer into the model and dampen the variability of topline revenue to T&E spend and become something of a moat for EXFY against competition attempting to poach customers. Corporate card transactions, Payroll and (then when EXFY is fully entrenched in their client’s operations) pricing power are the growth vectors for the next half decade, which should all be additive to core subscription revenue.

I’ll admit I am a sucker for these kinds of stories that have multiple, believable growth vectors that not only complement the core business, but could stand as independent business lines themselves. It’s the SQ playbook through and through - Serve your customer on multiple fronts, give them all sorts of useful solutions at minimal incremental cost and then its very hard for them to churn from you.

Let’s also not forget that EXFY is incubating these growth vectors while running slightly positive on an operating basis. That’s rare to see.

If the setup is cloudy, why mention EXFY now?

For lack of a better term, pattern recognition. To me, EXFY has the same look as BILL at IPO.

Similar services

Similar customer bases

No question about unit economics

Both taking share from entrenched legacy enterprise software services

Dynamic founder/CEOs

Went public to raise funds to play offense

Went public in a bad backdrop for growth but retained premium multiple

EBIT positive and/or fully in control of their own profitability

Will never be a cheap stock

Biggest Risks

Competition

Most investment shops that pass on EXFY will pass because of competition. There is a lot of it. Expense tracking is perceived as a low barrier to entry industry that has many players who are constantly calling on their competition’s clientele. This is precisely why EXFY loses 10+% of its client logos every year.

The 800lb gorilla in the expense reporting space is SAP Concur. Concur is the gold standard enterprise tool for expense tracking, but anyone who has used it knows that it is garbage… Expensive garbage sold top down rather than bottom up. Users and back office accounting departments both seem to hate it in unison. This is why Concur is the share giver to everyone else in the industry.

The most relevant direct competitors to EXFY in SMB-land are:

Divvy - Founded 2016, raised $418 million through Series D

Acquired by BILL in May 2021 for $625 million in cash and $1.875 billion of stock

Brex - Founded 2017, raised $1.5 billion through Series E

Ramp - Founded 2019, raised $610 million through Series C

Airbase - Founded 2017, raised $90 million through Series B

For Reference

EXFY - Founded 2008, raised $38.2 million through Series C

Aside: It is surprising to think that while all these corporate card startups in Silicon Valley were raising hundreds of millions to compete with EXFY, Barrett was buying out his Series A investor. He zigged while everyone else zagged. Seems to be a trend.

Competitive differentiation appears to come from the usability of the services both by the end user and the accounting department. Many of the newer startups have flashy user interface, but fail when selling into medium sized businesses by not having proper integrations with ERP software stacks like NetSuite.

Expensify has made itself formidable competition to these newer startups by having a user interface that is “good enough” or “does what it needs to do very well” and back office integrations that are no hassle. EXFY is often described as a service that “just works.” There is no better business compliment than that.

In my opinion, the biggest threat to EXFY is Divvy. The fact that BILL chose to acquire Divvy as opposed to any of the other startup competitors tells you something on the surface. They were clearly the best option, assuming BILL had its pick of the litter.

Divvy and EXFY are comparable businesses in terms of topline revenue (per BILL’s disclosures related to Divvy). But now Divvy will have the cross-sell firepower of Bill.com behind it, which opens the door to hundreds of thousands of SMBs, ostensibly some of whom are using Expensify.

It looks like EXFY and BILL will be butting heads sooner rather than later. This is a big risk because EXFY is outgunned. But hey, they have been outgunned by startups with superior stacks of cash for half a decade now and somehow found a way to win.

David Barrett

My general opinion of Barrett is that he’s a winner. This is a guy who is going to refuse to lose. But he’s a risk. There is one instance in particular where Barrett became the problem.

During the last Presidential election, Barrett sent a politically charged email to 10 million users of Expensify products (by the way, only 667k paid members per most recent quarter, lots of greenfield there). This action belongs in the Pantheon of corporate Own Goals. It certainly did not help EXFY’s churn figures. Let’s hope that Barrett has learned his lesson in this regard.

Closing Remarks

This post is getting way too long, I’ll close it here with some final thoughts.

In this post, I called EXFY anti-fragile and I think that is the right term to use. Dare I use the term durable?

2020 was the worst possible thing that could have happened to this business. For a lot of companies it was a knock out punch. EXFY not only survived but thrived. They innovated. They probably took share from the well funded corporate card companies during the turmoil. They hardly lost money on an EBIT basis!

When I first started reading about this business, I expected it to be fragile or highly susceptible to travel and the macro backdrop. While topline is T&E-beta positive, I was pleasantly surprised to see how adaptive the financial model is to those periods of distress. In addition, all of the growth vectors currently being rolled out are meant to dampen that variability. I just can’t help but like it. They are doing all the right things.

In terms of price targets or valuation, it’s hard to say a number or a valuation with a straight face given where the shares are trading. Today (12/31/21), EXFY is trading in excess of 17x Fwd EV/Rev. When I started writing this post, it was well lower (12-13x if I recall correctly).

I tend to think that this business should have a premium multiple given the strength of the business, the durable financial model, the fact that BILL is its closest comparable and the implied put provided by the Divvy acquisition at $2+ billion.

EXFY is like SEMR in that I am willing to be patient to see the growth vectors mature. I think the planned growth vectors, namely payroll, could provide multiples of current run rate revenue. That’s enough incentive for me to sit tight through the lap noise in 2022 and let the EXFY team execute.

Well, this post is far too long now. I’ll leave it at that. Have a great day everyone!

Disclaimer: I hold shares in EXFY. This is not financial advice. Do not trust an anonymous person on the internet for financial matters. Do your own due diligence. Consult a financial advisor. Be responsible.